As we adapt to a post-Brexit world with Covid, accountants are also trying to look forward to the next phase of MTD (Making Tax Digital) for Income Tax and Self Assessment.

This will affect the self employed and those with rental income (not profit) of more than £10,000 per year. I won’t go into the detail as that is available elsewhere, but I wanted to point out the timescales and why we’re already taking action with our own clients.

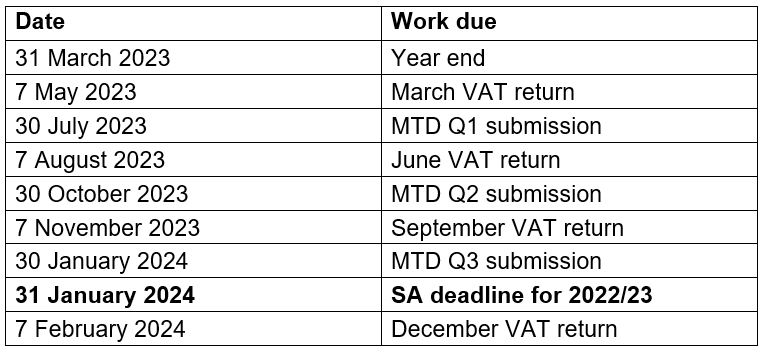

It’s quite a busy timeline. Most self employed use a 31 March or 5 April year end but, if not, you will have to provide current figures before the actual year end is complete. The timeline below is for a 31 March year end with a similar VAT quarter. As you can see it will be a busy 10 months with 2022/23 SA submissions to be done at the same time as 2023/24 quarterly submissions.

Of course, we’re still awaiting a lot of detail from HMRC, but our plan is:

– 2021/22 get all clients onto software with monthly bookkeeping (theirs or ours) checked by Xavier (Dext Precision) to ensure up to date digital records

– 2022/23 dummy run of MTD with a soft close each quarter to iron out any problems

– 2023/24 go live knowing that HMRC will probably offer a soft landing

Have you started to think about the next stage of MTD yet?