We submitted 36% of our self assessment returns in January!

Last year I submitted only one in January so what changed?

Well, I acquired Longhill Accounts in June and we spend three months meeting, greeting, and onboarding nearly 200 new clients May – July. For the most part this went through smoothly although some had problems signing up to Accountancy Manager as they weren’t used to technology. Poor rural internet service means that many clients still do things manually as it’s more reliable.

Once they were on board we then had to set each new client up on Xero or Xero Ledger in order to use XeroTax. And, of course, each client takes longer in the first year as we had to familiarise ourselves with them and their business. Because no two businesses are identical.

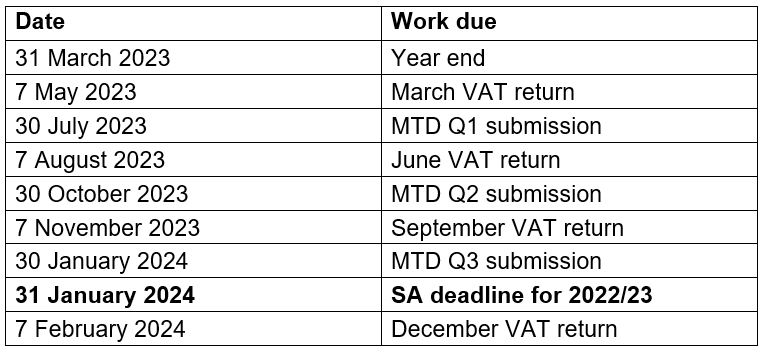

But we don’t just do self assessment returns, we also has to keep up with limited companies’ accounts and corporation tax, bookkeeping, VAT, and management accounts. So when we had caught up everything that clients had sent in proactively we STARTED to send the annual reminders. Usually we would send reminders in April, June, and September with final reminders going out in October. This year we didn’t send the FIRST reminders until the end of November.

Then Accountancy Manager rebranded as Bright Manager AND CHANGED ALL THE LINKS! So our poor new clients now had to handle a second set of instructions from us (once we realised that this was the problem!).

In spite of all that the team worked their socks off over weekends and evenings in December and January and we finally submitted the last return with 3 days to spare.

But this fabulous team shouldn’t have to work so hard and neglect their personal lives.

We’re busy celebrating now but today we had our quarterly planning meeting to make sure that we have a much better tax return season this year. I intend to go skiing in January 2025 so we need everything submitted before Christmas. Watch this space …